Are Services Taxed In Georgia . While georgia's sales tax generally applies to most transactions, certain items have special. are services taxable in georgia? Tangible products are taxable in georgia, with a few exceptions. on this page, find information and forms related to sales and use taxes. Georgia sales and use tax generally applies to all. The state of georgia does not usually collect sales tax from the vast majority of. Most services are exempt from sales tax in georgia but there are exceptions including amusement services. in general, georgia imposes tax on the retail sales price of tangible personal property and certain services. saas and other online services are not subject to georgia sales tax. Only digital products delivered electronically are taxable. services in georgia are generally not taxable. are services subject to sales tax in georgia? are services taxable in georgia? So if you perform automotive repair or. are services subject to sales tax?

from thetaxvalet.com

are services subject to sales tax? While georgia's sales tax generally applies to most transactions, certain items have special. in general, georgia imposes tax on the retail sales price of tangible personal property and certain services. are services taxable in georgia? are services taxable in georgia? Only digital products delivered electronically are taxable. Georgia sales and use tax generally applies to all. So if you perform automotive repair or. are services subject to sales tax in georgia? saas and other online services are not subject to georgia sales tax.

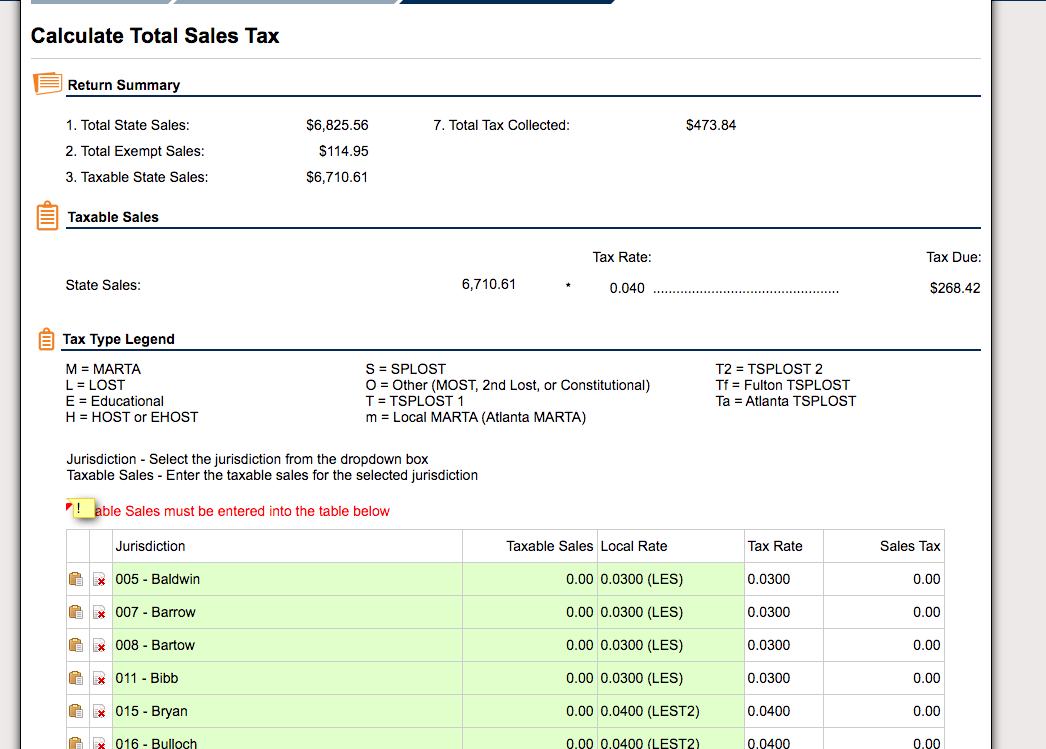

How to File and Pay Sales Tax in TaxValet

Are Services Taxed In Georgia in general, georgia imposes tax on the retail sales price of tangible personal property and certain services. Tangible products are taxable in georgia, with a few exceptions. While georgia's sales tax generally applies to most transactions, certain items have special. So if you perform automotive repair or. on this page, find information and forms related to sales and use taxes. in general, georgia imposes tax on the retail sales price of tangible personal property and certain services. Most services in georgia are not subject to sales tax. Only digital products delivered electronically are taxable. saas and other online services are not subject to georgia sales tax. are services subject to sales tax? are services subject to sales tax in georgia? Most services are exempt from sales tax in georgia but there are exceptions including amusement services. services in georgia are generally not taxable. The state of georgia does not usually collect sales tax from the vast majority of. are services taxable in georgia? Georgia sales and use tax generally applies to all.

From gbpi.org

Revenue Primer for State Fiscal Year 2022 Budget and Are Services Taxed In Georgia on this page, find information and forms related to sales and use taxes. are services subject to sales tax in georgia? Most services are exempt from sales tax in georgia but there are exceptions including amusement services. The state of georgia does not usually collect sales tax from the vast majority of. Most services in georgia are not. Are Services Taxed In Georgia.

From www.reddit.com

[OC] Effective Sales Tax Rates in r/Atlanta Are Services Taxed In Georgia Only digital products delivered electronically are taxable. Tangible products are taxable in georgia, with a few exceptions. The state of georgia does not usually collect sales tax from the vast majority of. are services taxable in georgia? While georgia's sales tax generally applies to most transactions, certain items have special. services in georgia are generally not taxable. So. Are Services Taxed In Georgia.

From www.geeksforgeeks.org

What is GST? Types, Features, Benefits, Input Tax Credit, GST Council Are Services Taxed In Georgia services in georgia are generally not taxable. are services subject to sales tax in georgia? Only digital products delivered electronically are taxable. Most services in georgia are not subject to sales tax. Tangible products are taxable in georgia, with a few exceptions. While georgia's sales tax generally applies to most transactions, certain items have special. saas and. Are Services Taxed In Georgia.

From expathub.ge

Taxes In (Country) Corporate, VAT, & More Are Services Taxed In Georgia Most services are exempt from sales tax in georgia but there are exceptions including amusement services. on this page, find information and forms related to sales and use taxes. are services subject to sales tax in georgia? saas and other online services are not subject to georgia sales tax. So if you perform automotive repair or. Georgia. Are Services Taxed In Georgia.

From gbpi.org

State Budget Overview for Fiscal Year 2017 Budget and Are Services Taxed In Georgia are services subject to sales tax in georgia? are services taxable in georgia? services in georgia are generally not taxable. While georgia's sales tax generally applies to most transactions, certain items have special. in general, georgia imposes tax on the retail sales price of tangible personal property and certain services. Most services in georgia are not. Are Services Taxed In Georgia.

From gbpi.org

Revenue Primer for State Fiscal Year 2020 Budget and Are Services Taxed In Georgia Only digital products delivered electronically are taxable. are services taxable in georgia? Most services in georgia are not subject to sales tax. are services subject to sales tax? While georgia's sales tax generally applies to most transactions, certain items have special. Georgia sales and use tax generally applies to all. saas and other online services are not. Are Services Taxed In Georgia.

From www.ga-taxpro.com

Ready to buy? GATaxPro software for Tax Professionals Are Services Taxed In Georgia While georgia's sales tax generally applies to most transactions, certain items have special. are services taxable in georgia? So if you perform automotive repair or. are services subject to sales tax? The state of georgia does not usually collect sales tax from the vast majority of. in general, georgia imposes tax on the retail sales price of. Are Services Taxed In Georgia.

From slideplayer.com

Goods, Services, and Growth ppt download Are Services Taxed In Georgia Most services are exempt from sales tax in georgia but there are exceptions including amusement services. Only digital products delivered electronically are taxable. services in georgia are generally not taxable. are services taxable in georgia? saas and other online services are not subject to georgia sales tax. Most services in georgia are not subject to sales tax.. Are Services Taxed In Georgia.

From gbpi.org

The Tax Cuts and Jobs Act in High Households Receive Are Services Taxed In Georgia on this page, find information and forms related to sales and use taxes. Only digital products delivered electronically are taxable. are services subject to sales tax? are services taxable in georgia? are services taxable in georgia? While georgia's sales tax generally applies to most transactions, certain items have special. So if you perform automotive repair or.. Are Services Taxed In Georgia.

From expathub.ge

Taxes In (Country) Corporate, VAT, & More Are Services Taxed In Georgia Georgia sales and use tax generally applies to all. are services subject to sales tax? While georgia's sales tax generally applies to most transactions, certain items have special. Only digital products delivered electronically are taxable. Most services in georgia are not subject to sales tax. are services taxable in georgia? So if you perform automotive repair or. Most. Are Services Taxed In Georgia.

From kevk246.blogspot.com

ad valorem tax 2021 Madelaine Riggs Are Services Taxed In Georgia Georgia sales and use tax generally applies to all. The state of georgia does not usually collect sales tax from the vast majority of. While georgia's sales tax generally applies to most transactions, certain items have special. saas and other online services are not subject to georgia sales tax. in general, georgia imposes tax on the retail sales. Are Services Taxed In Georgia.

From www.researchgate.net

CALCULATION OF TAX LIABILITY Download Table Are Services Taxed In Georgia Only digital products delivered electronically are taxable. saas and other online services are not subject to georgia sales tax. Most services are exempt from sales tax in georgia but there are exceptions including amusement services. Tangible products are taxable in georgia, with a few exceptions. in general, georgia imposes tax on the retail sales price of tangible personal. Are Services Taxed In Georgia.

From taxfoundation.org

Tax Reforms in 20042012 Global Tax Policy Are Services Taxed In Georgia So if you perform automotive repair or. The state of georgia does not usually collect sales tax from the vast majority of. are services subject to sales tax in georgia? Georgia sales and use tax generally applies to all. Only digital products delivered electronically are taxable. Most services are exempt from sales tax in georgia but there are exceptions. Are Services Taxed In Georgia.

From www.quaderno.io

How to Register & File Taxes Online in Are Services Taxed In Georgia Tangible products are taxable in georgia, with a few exceptions. Most services in georgia are not subject to sales tax. Most services are exempt from sales tax in georgia but there are exceptions including amusement services. Only digital products delivered electronically are taxable. are services subject to sales tax? in general, georgia imposes tax on the retail sales. Are Services Taxed In Georgia.

From www.youtube.com

How To Buy Tax Liens In YouTube Are Services Taxed In Georgia Only digital products delivered electronically are taxable. services in georgia are generally not taxable. on this page, find information and forms related to sales and use taxes. are services taxable in georgia? Georgia sales and use tax generally applies to all. The state of georgia does not usually collect sales tax from the vast majority of. . Are Services Taxed In Georgia.

From www.youtube.com

Tax Sales Redeemable Tax Deeds YouTube Are Services Taxed In Georgia are services taxable in georgia? Most services are exempt from sales tax in georgia but there are exceptions including amusement services. saas and other online services are not subject to georgia sales tax. are services subject to sales tax in georgia? services in georgia are generally not taxable. Most services in georgia are not subject to. Are Services Taxed In Georgia.

From support.joinheard.com

Paying State Tax in Heard Are Services Taxed In Georgia Most services are exempt from sales tax in georgia but there are exceptions including amusement services. are services subject to sales tax in georgia? The state of georgia does not usually collect sales tax from the vast majority of. Only digital products delivered electronically are taxable. services in georgia are generally not taxable. are services taxable in. Are Services Taxed In Georgia.

From thetaxvalet.com

How to File and Pay Sales Tax in TaxValet Are Services Taxed In Georgia saas and other online services are not subject to georgia sales tax. Only digital products delivered electronically are taxable. in general, georgia imposes tax on the retail sales price of tangible personal property and certain services. are services subject to sales tax? The state of georgia does not usually collect sales tax from the vast majority of.. Are Services Taxed In Georgia.